All Categories

Featured

Table of Contents

- – Not known Factual Statements About Best Cheap ...

- – The Best Strategy To Use For What Is No Medica...

- – The Ultimate Guide To What Is Instant Life In...

- – Indicators on What Is No Medical Exam Life In...

- – The 30-Second Trick For Guaranteed Issue Lif...

- – All about Best Cheap No-exam Life Insurance ...

- – The Best Strategy To Use For What Is No-exam...

[/image][=video]

[/video]

With immediate life insurance coverage, there's no need for an intrusive or inconvenient clinical test, as you can use and get protection without one. Because of the very easy application procedure and no clinical examination, this life insurance coverage costs may cost you more than a typical term life or whole life policy.

Store around and contrast various plans from different insurers. Check out the premiums, protection amounts, terms, and insurance company track record. This helps you locate a plan that provides the very best value for your demands. Choose a term length that lines up with your monetary obligations. For instance, if you have children, a term that covers them until they are independent grownups may be ideal.

Not known Factual Statements About Best Cheap No-exam Life Insurance For Term & Whole Life

If you think this protection is ideal for you, you may likewise gain from an Aflac guaranteed-issue term or entire life insurance policy plan with a fast application process. Gone are the days when you have no choice of getting a life insurance plan. Today, numerous insurance provider are providing immediate life insurance policy.

Aflac offers guaranteed issue life insurance coverage with no underwriting process. Plus, rates are much more expense reliable and you can pick the correct amount to fit your requirements. Contact an Aflac agent today for a quote or even more details.

Insurance companies have actually figured out exactly how to offer individuals with life insurance without a medical exam., specifically because setting up an examination might be difficult for workers that get little or no paid time off.

The premiums you might spend for this kind of insurance coverage may be approximately the very same as if you undertook a typical clinical test. The insurance coverage levels are additionally about the very same as conventional life insurance policy. The process for requesting simplified issue life insurance policy resembles that of increased underwriting life insurance, except that you may have to address less inquiries.

The turn-around for acceptance is generally quicker, in some cases as quickly as the very same day you apply. The flip side to this higher benefit is that there might be a better opportunity you will be declined for a policy. For certain individuals and particular requirements, streamlined issue policies might be the optimal choicea way to get some useful life insurance policy protection rapidly and just.

The Best Strategy To Use For What Is No Medical Exam Life Insurance?

Surefire problem is generally extra costly than simplified issue life insurance policy or increased underwriting life insurance policy. On top of that, the optimum quantity of coverage provided is typically lower than with those various other types of plans. Many policies have a "rated fatality benefit," implying that if you pass away within a defined home window of time after the start of your plan, the insurer might refund the costs paid right into the policy, yet not pay the fatality benefit.

The insurance coverage used is typically standard and may not be sufficient to care for kids or a spouse for the lengthy term. If you leave the company, you may lose the insurance coverage. Make sure you're satisfied with the survivor benefit prior to you decide to make this your only life insurance policy.

A device of insurance coverage corresponds to the life insurance policy benefit amount you can buy. It depends upon age, sex (in Montana, age just) and state. Please obtain a quote to see benefit quantities and costs offered to you for approximately 15 devices of insurance coverage.

The Ultimate Guide To What Is Instant Life Insurance?

If you qualify, immediate life insurance coverage plans can be an economical, simple alternative that cuts your application examination down from weeks to just minutes. For those healthy who desire life insurance policy promptly, there are immediate options with a large range of coverage amounts. Instant-issue life insurance policy policies are typically term life.

: Smoking might disqualify you from instant life insurance policy, but if that's the situation, there are various other life insurance policy choices for smokers.: You might be asked if you've been refuted by a life insurer before or if you have various other life policies.: The firm will certainly need details like your name, birthdate, elevation and weight, Social Safety number, and citizenship to examine your application and issue a plan.

If your application is denied, the insurance provider may refer you to various other life insurance coverage kinds. Assessing an instant life insurance policy application generally includes running your info through an algorithm that simplifies threat evaluation, so don't let a rejection quit you from searching for life insurance coverage. Always be straightforward in a life insurance policy application, as existing or holding back inquired could be taken into consideration life insurance scams.

Indicators on What Is No Medical Exam Life Insurance You Need To Know

It's no trick that life insurance can be an inconvenience. If that's why you have actually been placing off purchasing a plan, we have a wonderful option for you: "no exam term life insurance policy".

Depending on the carrier, you may be authorized in hours or days. That's a huge renovation over common completely underwritten policies that can take weeks to process! Prior to we go additionally, let's speak about that medical examination. The examiner pertains to your office or home and asks in-depth questions regarding your wellness, genes, and way of life.

If your lab results disclose such a condition, the insurance company might pick not to provide coverageor provide a reduced quantity of protection at a much more pricey rate. If that doesn't seem appealing, you're not alone. When it involves, no medical examination life insurance policies make it very easy to obtain covered without the uneasy and taxing procedure of a medical examination.

The 30-Second Trick For Guaranteed Issue Life Insurance Policies

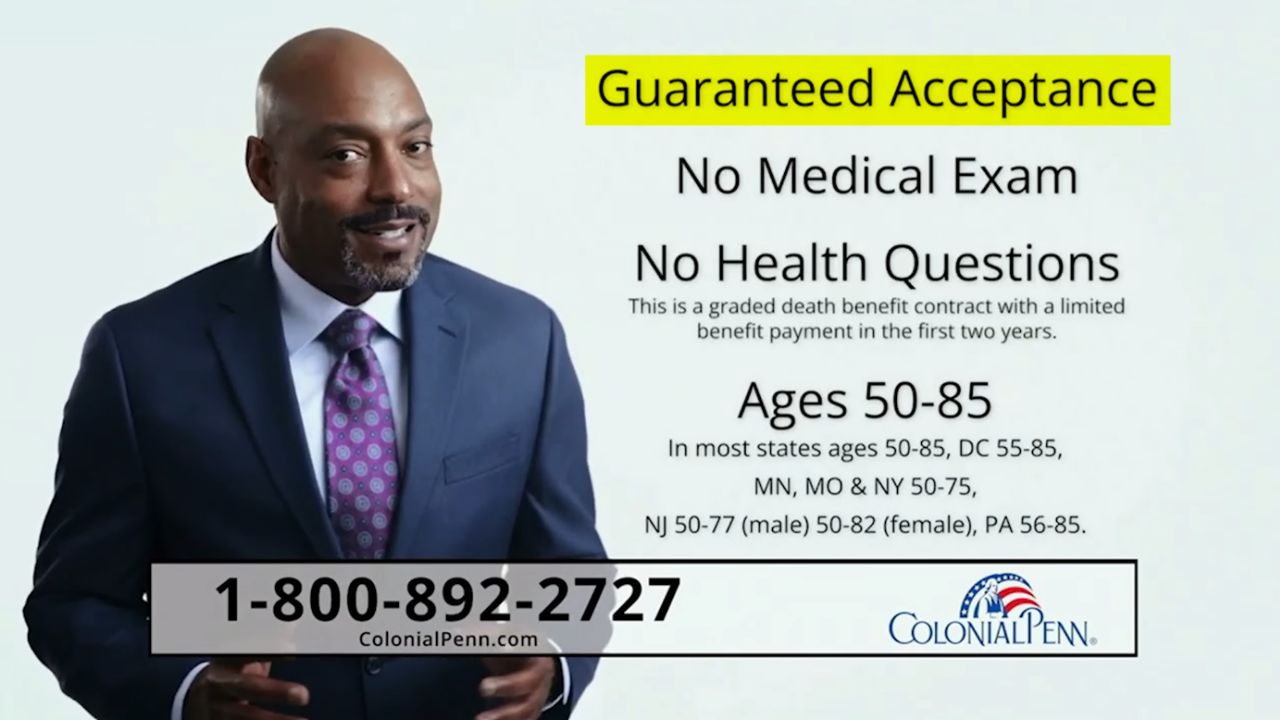

Guaranteed Issue Life Insurance does not require medical examinations or health and wellness sets of questions. This kind of insurance is excellent for individuals with pre-existing conditions or older grownups. Premiums are usually greater, and protection quantities are less than conventional life insurance policy. Several plans have a waiting duration, usually 2-3 years prior to the complete fatality benefit is available.

Surefire problem life insurance policy is a kind of life insurance policy plan that doesn't need you to go through a medical examination or answer a considerable wellness set of questions to qualify. This makes it an appealing option for people with pre-existing clinical conditions, advanced age, or serious wellness conditions that may not be qualified for even more traditional life insurance policy policies.

Guaranteed problem global life insurance policy does not need a clinical examination.: This kind of life insurance, with lower coverage quantities, is particularly designed to cover funeral and interment prices and other end-of-life expenses.

All about Best Cheap No-exam Life Insurance For Term & Whole Life

: The application process for ensured concern life insurance policy is commonly much faster than that for various other sorts of policies. If you require coverage swiftly, possibly because of an upcoming life event like marriage or the birth of a child, this can be an excellent option.: If you have actually obtained traditional life insurance policy and been rejected, assured concern life insurance coverage provides a way to secure some degree of insurance coverage.

: After the waiting duration, if the guaranteed individual passes away, the beneficiaries obtain the complete death advantage, usually as a tax-free lump sum.: Given that there are no clinical concerns or tests, the payment is assured no matter of any kind of pre-existing conditions as long as the waiting period has passed.

The Best Strategy To Use For What Is No-exam Life Insurance And How Does It Work?

It is essential to keep in mind that the specifics of these insurance plans can vary commonly depending on the insurance provider and the certain policy terms. Constantly examine the policy's details and speak with an insurance professional to totally recognize the benefits, restrictions, and costs. Surefire problem life insurance policy has a number of benefits, making it an appealing alternative for sure people.

This makes it quicker and easier to obtain approved for a plan. Since there's no need for clinical underwriting, the authorization procedure is typically much faster than with traditional life insurance policy.

Table of Contents

- – Not known Factual Statements About Best Cheap ...

- – The Best Strategy To Use For What Is No Medica...

- – The Ultimate Guide To What Is Instant Life In...

- – Indicators on What Is No Medical Exam Life In...

- – The 30-Second Trick For Guaranteed Issue Lif...

- – All about Best Cheap No-exam Life Insurance ...

- – The Best Strategy To Use For What Is No-exam...

Latest Posts

An Unbiased View of Get Instant Life Insurance Quotes Online For Fast Coverage!

Some Ideas on Life Insurance: Policies, Information & Quotes You Should Know

The Greatest Guide To No Exam Life Insurance Quote - Nationwide

More

Latest Posts

An Unbiased View of Get Instant Life Insurance Quotes Online For Fast Coverage!

Some Ideas on Life Insurance: Policies, Information & Quotes You Should Know

The Greatest Guide To No Exam Life Insurance Quote - Nationwide